XRP, often associated with the company Ripple, is a prominent digital asset that aims to revolutionize the world of cross-border payments. Whether you’re new to cryptocurrencies or looking to understand what sets XRP apart, this beginner’s guide covers everything you need to know.

What is Ripple?

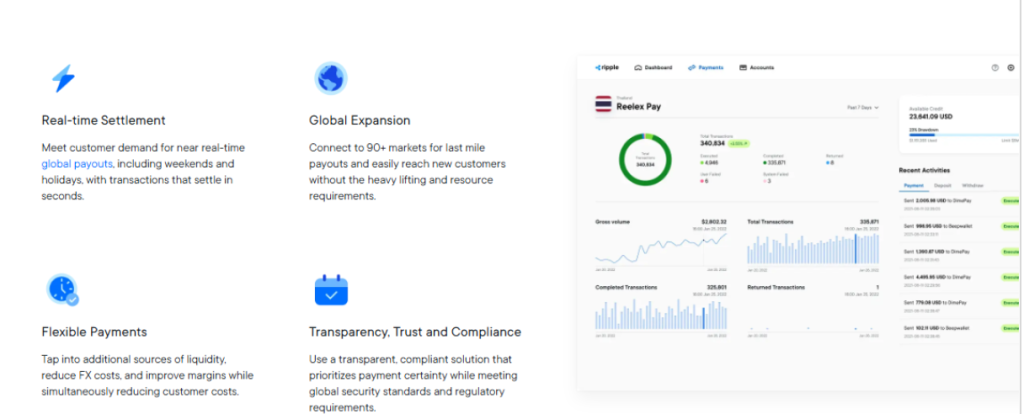

Ripple Labs Inc. is a San Francisco-based fintech company that focuses on developing global payment solutions. Ripple’s flagship product is RippleNet, a decentralized network designed to enable real-time, low-cost international money transfers between financial institutions.

Ripple is not a blockchain but rather a company that utilizes blockchain technology through the XRP Ledger (XRPL). Its goal is to eliminate the inefficiencies of traditional banking systems like SWIFT.

What is XRP?

XRP is the native digital currency of the XRP Ledger. It acts as a bridge currency in Ripple’s ecosystem, enabling fast and efficient transactions between different fiat currencies without the need for pre-funded accounts.

Unlike Bitcoin, XRP is pre-mined, with a total supply of 100 billion tokens, and is distributed periodically by Ripple Labs. It is not reliant on mining and consumes far less energy.

Ripple vs XRP vs XRP Ledger: What’s the Difference?

Ripple: The Company

Ripple Labs is the company that develops products like RippleNet and On-Demand Liquidity (ODL). They use XRP to facilitate transactions.

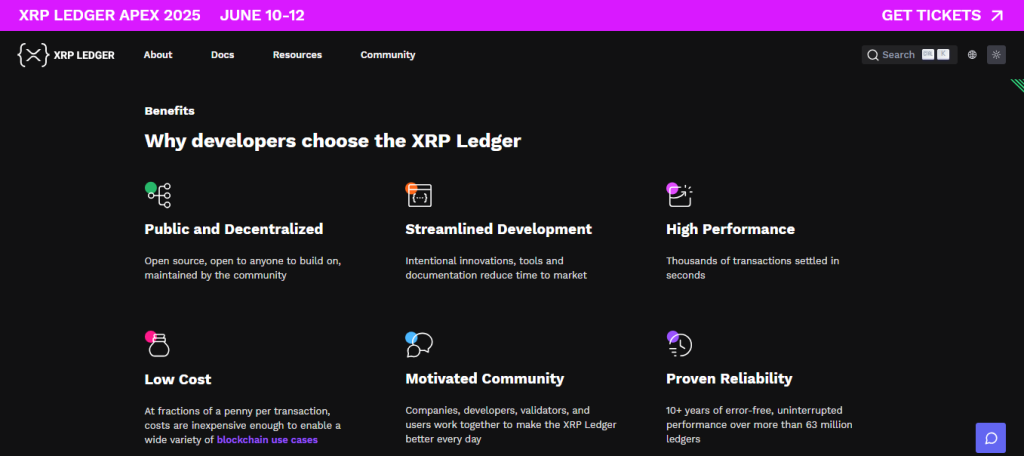

XRP Ledger: The Blockchain

The XRP Ledger (XRPL) is a decentralized, open-source blockchain that processes XRP transactions. It uses a consensus protocol instead of the traditional proof-of-work (PoW) or proof-of-stake (PoS).

XRP: The Asset

XRP is the digital currency used within the XRP Ledger to power transactions and provide liquidity.

How Does Ripple Work?

RippleNet utilizes XRP as a bridge asset to settle transactions almost instantly, at minimal cost. Here’s how the process typically works:

- A sender initiates a transaction.

- XRP is used to convert one currency into another.

- The recipient receives the funds within seconds.

Transactions are verified through the Ripple Protocol Consensus Algorithm (RPCA), which allows the network to process over 1,500 transactions per second (TPS).

XRP’s Use Cases

- Cross-border payments

- Banking infrastructure upgrades

- Liquidity provisioning for financial institutions

- Micropayments and remittances

Ripple has partnered with over 300 banks and financial institutions, including Santander and PNC Bank, for real-world adoption.

Advantages and Disadvantages of XRP

Advantages

- Fast transaction speed (3-5 seconds)

- Low fees (usually less than $0.01 per transaction)

- Scalable (over 1,500 TPS)

- Environmentally friendly (no mining)

- Institutional support from major financial firms

Disadvantages

- Centralization concerns due to Ripple Labs holding a large share of XRP

- Regulatory scrutiny, particularly from the SEC

- Limited use cases compared to other utility tokens

- Price volatility

The SEC vs Ripple

In December 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, alleging that XRP was an unregistered security. This caused massive market disruption and raised questions about the future of XRP.

In 2023, a partial ruling declared that XRP is not a security when traded on public exchanges, but the case continues to influence investor sentiment and market movements.

What Makes XRP Unique?

- XRP uses a consensus algorithm, not mining, to validate transactions.

- It’s one of the most energy-efficient cryptocurrencies.

- Institutional partnerships give it real-world use cases.

- Designed for financial institutions, not individual miners or stakers.

- Acts as a bridge currency, which differentiates it from store-of-value cryptos like Bitcoin.

What Can You Do with Ripple (XRP)?

How to Buy XRP

You can purchase XRP on popular crypto exchanges like:

- Binance

- Kraken

- Bitstamp

- Caleb & Brown

Make sure the platform complies with your region’s regulations.

How to Store XRP

Use software wallets (like Trust Wallet or Exodus) or hardware wallets (like Ledger Nano X) for secure storage. The XUMM wallet is a popular option specifically for XRP users.

The Future of XRP

The resolution of Ripple’s legal issues could significantly impact XRP’s future. Ongoing developments like CBDC integration, tokenization, and institutional adoption may increase utility and price potential.

Ripple continues to expand into regions like Asia-Pacific and the Middle East, signaling a long-term vision beyond the U.S. market.

FAQs

Is XRP a good investment?

It depends on your risk tolerance. XRP has real-world utility, but ongoing legal issues add uncertainty.

Can XRP reach $10?

While speculative, XRP reaching $10 would require massive adoption, favorable regulation, and increased utility.

Is XRP better than Bitcoin?

They serve different purposes. Bitcoin is a store of value; XRP is optimized for fast, low-cost transactions.

How much is 1 XRP worth right now?

Check real-time prices on exchanges or financial websites.

What is the average transaction fee on XRP?

Typically less than $0.01 per transaction, making it one of the cheapest crypto networks.

Who created XRP?

XRP was created by Jed McCaleb, David Schwartz, and Arthur Britto in 2012. Ripple Labs was later formed to develop enterprise solutions around it.

What consensus mechanism does XRP use?

The Ripple Protocol Consensus Algorithm (RPCA) — a unique, non-mining mechanism using validators.

Trade XRP with Caleb & Brown

For secure, over-the-counter crypto trading with personalized support, consider using Caleb & Brown, a trusted digital asset brokerage.